Introduction to Seed Capital

Seed capital represents the crucial early-stage funding where investors provide vital capital, transforming innovative ideas into viable businesses. In this edition, we offer expert insights and strategies on how to efficiently navigate this process.

Introduction to Private Credit: Structuring and Valuation

In this edition, we will discuss the critical nuances that should be considered when structuring and valuing private credit focused investment funds in the US.

Ensuring a smooth audit

Each year Opus participates in hundreds of audits and this third edition of our Opus Insights series will offer practical and actionable advice from industry leaders on the best practices to ensure a smooth, timely and stress free audit cycle.

Latest Advisers Act changes by the SEC Part 2

This webinar is the second part of our series discussing the recently adopted changes by the Securities and Exchange Commission (“SEC” or “Commission”) under the Investment Advisers Act of 1940 (the “Advisers Act”) governing private fund advisers (the “Final Rule”). According to the SEC, the Final Rules are designed to enhance the protection of private fund investors, including (1) increased transparency with respect to fees, expenses, compensation, and performance and (2) certain restrictions on advisers’ activities relating to their private funds.

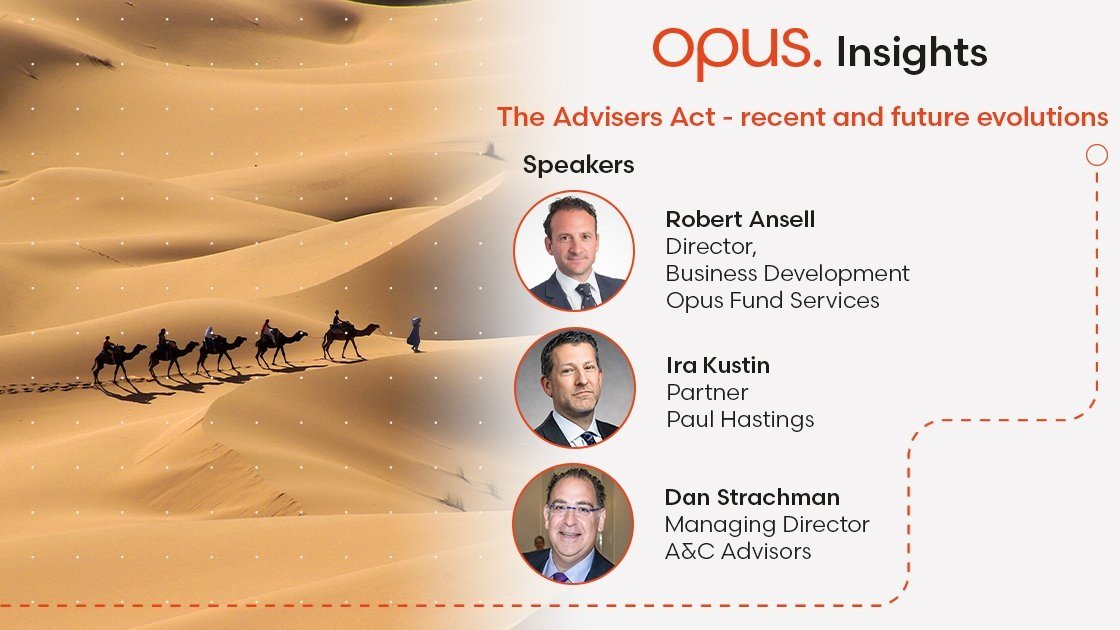

The Advisers Act - recent and future evolutions

Introducing our very first Opus Insights event featuring topical conversations with leaders of industry! Thank you to Ira kustin from Paul Hastings and Dan Strachman from A&C Advisors for their participation and providing insightful information on the recent changes proposed by the Securities and Exchange Commission (“SEC” or “Commission”). Thanks also to all those who attended and for those who couldn't make it, you can watch the full video by clicking on the link below.